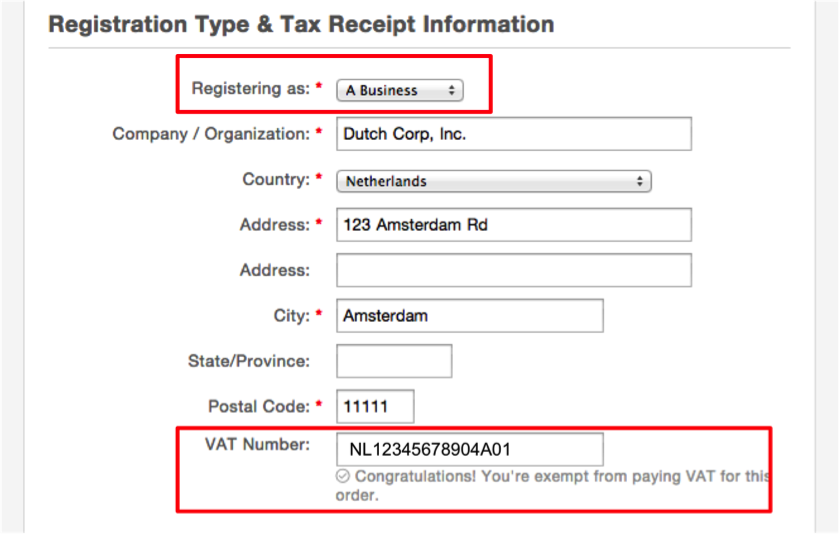

We cross check this with the vast companies database on Datalog. A value added tax identification number or VAT identification number ( VATIN) is an identifier used in many countries, including the countries of the European Union, for value added tax purposes.

It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. All Dutch private individual businesses have a VAT identification number (btw-id ) and a VAT tax number. The digits are not related to your citizen service number and the check digits are random.

VAT -Search has more than 6clients including By using VAT -Search. LinkedIn is committed to supporting our members and customers during COVID-19. To help us improve GOV. Help us improve GOV.

UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only minutes to fill in. A Value Added Tax ( VAT ) number used by businesses to collect VAT (a type of sales tax).

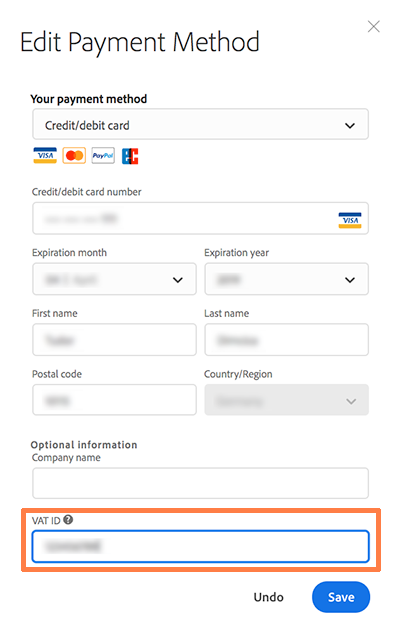

Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT. In particular, business is obliged to register. Find the subscription card for the subscription you want to update.

Getting these details right is done as a one-time setup in your invoicing software, and if you use a local consultant to guide you through the VAT process, you can negotiate to have this included in the fees. A Value-Added Tax ( VAT ) invoice is a document issued by an accountable person.

A VAT invoice sets out the details of a taxable supply and all related information as prescribed by VAT law. A VAT invoice must issue within fifteen days of the end of the month in which goods or services are supplied.

Apply for your EORI number in advance. VAT numarası örneği nasıldır? Avrupa birliği vergi mevzuatı kurallarına göre her ülkenin bir kdv kimlik numarası bulunmaktdır. There are three columns.

Unexpectedare displayed in red. Vat nasıl geri alınır? Value added tax is a general tax that applies, in principle, to all commercial activities involving the production and distribution of goods and the provision of services. However, if the annual turnover of this person is less than a certain limit (the threshold), which differs according to the Member State, the person does not have to charge VAT on their sales.

The VAT registration certificate is provided by the Inland Revenue Office (IRO) subsequent to VAT registration. Favorite Answer You cannot get a VAT registration number without being registered for VAT.

You must register if your vatable supplies exceed £60pa. Consequently, this term is colloquially used to describe a number of similar albeit legally different situations which carry different VAT implications.

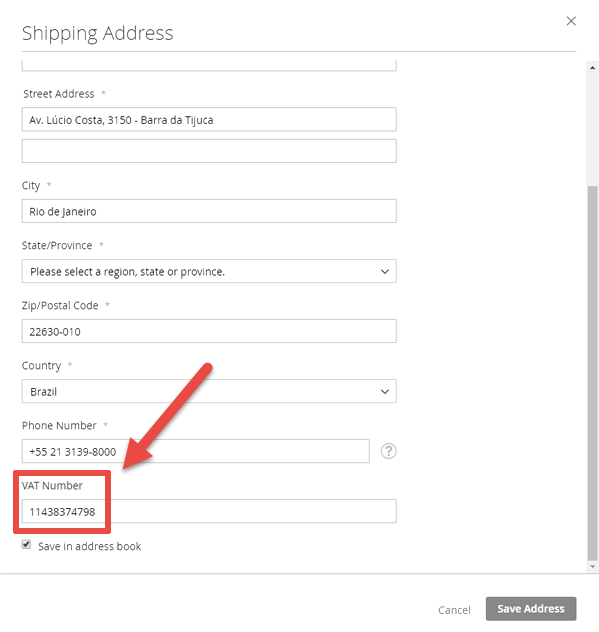

One factor that these situations do have in common, though, is that a re charge by one entity to another must, as the term itself implies, be preceded by a charge borne in the first place by the former. CNPJ (Cadastro Nacional da Pessoa Jurídica) is the Federal Tax Identification Number, a fourteen-digit number used as a tracking number by the Department of Federal Revenue of Brazil (Secretaria da Receita Federal do Brasil).

VAT registration number All self-billed invoices must include the statement “The VAT shown is your output tax due to HMRC” and you must clearly mark each self-billed invoice you raise with the reference: ‘Self Billing’ (This rule has the force of law). What is a debit note? A debit note can be issued by a customer to their supplier and be treated as a credit note. The debit note must be issued before a credit note is issued by the supplier and must be accepted by the supplier.

For exports from the EU, this normally takes the form of an EURMovement Certificate or you could become an Approved Exporter and quote a Customs Authorisation number. Information regarding Approved Exporters can be found in HMRC Public notices 8and 828. It stands for certificado de identificación fiscal.

It is a company registration number. Spanish registered companies, for instance with the status as an S. This provides formal registration on the company tax system in Spain. A primary account number is a 1 1 or digit number generated as a unique identifier for a primary account.

Primary account numbers are issued to payment cards such as credit and debit cards.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.